The Role of Personal Finance Apps in Managing American Household Budgets has grown significantly as these tools streamline money management and empower users to take control of their finances. Many apps utilize visual dashboards and automate tasks like bill payments and expense tracking, promoting transparency. These apps simplify money management, making it more accessible and less time-consuming, and have become a regular part of many people’s weekly routines.

In this article, you will learn:

- Personal finance apps simplify budgeting with visual dashboards and interactive elements, acting as digital financial advisors.

- These apps automate tasks such as bill payments and expense tracking, consolidating investments, debt, savings, bills, budgets, and credit scores in one place.

- By connecting to bank accounts, budgeting apps automatically log and categorize transactions, providing a clear overview of spending habits.

- Personal finance apps feature clean layouts and straightforward navigation, making it easier to monitor your budget without feeling overwhelmed.

- Many apps offer customizable alert settings, allowing users to set thresholds for spending, track progress towards savings goals, and receive notifications about unusual account activity.

- Personal finance apps aid debt management by offering clear strategies for efficient debt reduction, including projected timelines and debt snowball/avalanche calculators.

What role do personal finance apps play in managing American household budgets?

Personal finance apps have become essential tools for managing household budgets in the U.S., streamlining everyday money tasks and empowering individuals to take control of their financial lives. These apps offer a practical approach to tracking expenses, reducing debt, and achieving savings goals.

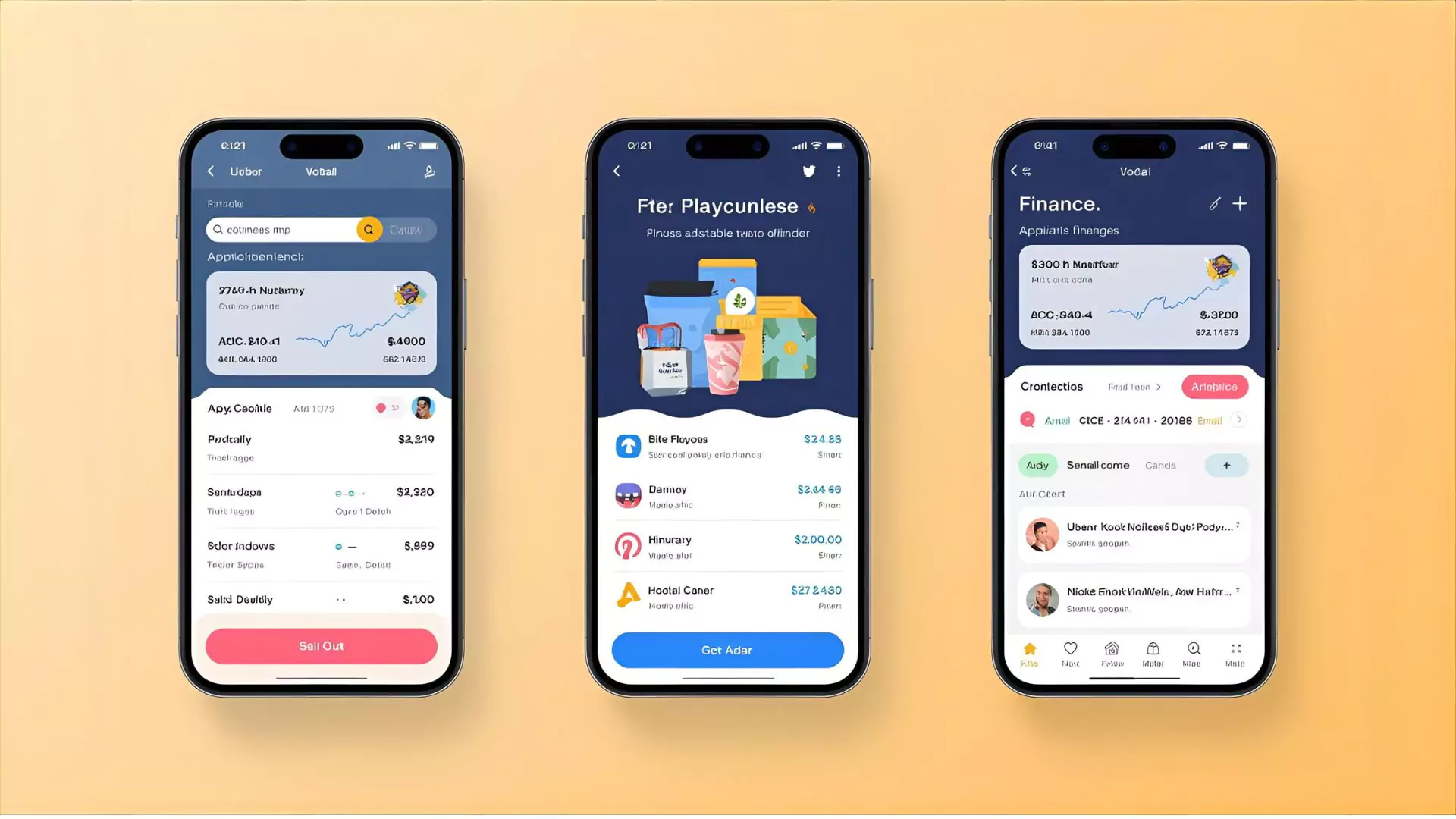

Many personal finance apps utilize visual dashboards and interactive elements to simplify budgeting. By monitoring transactions and providing personalized insights, these apps act as digital financial advisors, helping users understand their spending habits and make informed financial decisions. For example, some apps categorize spending automatically, showing how much is spent on dining out versus groceries each month.

These tools enhance the convenience of digital banking by automating tasks such as bill payments and expense tracking. Users can manage investments, debt, savings, bills, budgets, and credit scores in one centralized platform, promoting transparency and simplifying financial management. This all-in-one approach reduces the need to juggle multiple accounts and platforms.

Beyond basic tracking, budgeting apps identify spending trends and send reminders to keep users on track. Some apps support collaborative budgeting, enabling couples, families, or friends to work together toward shared financial goals. This collaborative feature can foster open communication and shared responsibility in managing finances.

How do these apps help track spending and achieve financial goals?

Budgeting apps streamline money management and goal achievement through features like expense tracking, personalized budgeting, and financial goal setting.

Once connected to your bank accounts, these apps automatically log transactions and categorize them (e.g., income, savings, spending). This provides a clear overview of spending habits, revealing exactly where your money goes. For example, you might discover you’re spending more on dining out than you realized, prompting a reevaluation of your budget.

By identifying overspending areas, these apps facilitate budget adjustments and prioritization of financial goals, such as debt reduction, emergency fund creation, or saving for significant purchases. Many apps also offer insights and recommendations tailored to your financial situation, helping you make informed decisions.

Users find these tools valuable for simplifying money management and fostering better financial habits, leading to increased confidence and control over their finances. The convenience and insights provided by these apps empower individuals to take proactive steps toward financial well-being.

Why are personal finance apps increasingly popular for American household budgeting?

More and more American households are turning to personal finance apps to handle their budgeting, and it’s easy to see why. These tools simplify money management, making it more accessible and less time-consuming.

With just a few taps, users can track spending, set savings goals, and monitor their progress. The convenience they offer has made them a regular part of many people’s weekly routines. Beyond just organizing expenses, these apps also provide insights that help users make smarter financial decisions and stay focused on their long-term goals.

For example, many apps offer personalized advice based on spending habits, suggesting ways to cut unnecessary expenses or optimize savings strategies. This proactive approach to financial management empowers users to take control of their financial futures.

How do they simplify budget management and improve financial literacy?

Personal finance apps simplify budget management with intuitive designs that guide users step-by-step. These apps feature clean layouts and straightforward navigation, making it easy to monitor your budget without feeling overwhelmed. This user-friendly approach enhances financial literacy by providing a clear understanding of personal finances.

A key feature is the automatic tracking of spending. Instead of manually logging every purchase, the app automatically categorizes transactions, providing a real-time snapshot of where your money is going. This automated tracking saves time and offers valuable insights into spending habits, promoting better financial awareness.

Many of these tools also enable users to set specific financial goals, such as saving for a down payment on a home or paying down debt. Progress can be monitored visually, and timely reminders help maintain motivation and focus. Goal-setting features often include calculators and planning tools to help users create realistic and achievable financial targets.

By consolidating income, expenses, and savings into a single platform, these apps offer a comprehensive view of your financial health. This clarity empowers users to make informed and confident decisions about their money, fostering better financial management and literacy. Users can quickly identify areas where they can cut expenses or allocate more funds to savings, leading to improved financial outcomes.

What key features should American households look for in personal finance apps?

American households can benefit greatly from using personal finance apps that send automatic alerts. These notifications serve as helpful reminders for upcoming bills and payment due dates, making it easier to stay organized and in control of your finances.

With timely prompts, it becomes much simpler to avoid missing payments, which can lead to costly late fees and damage to your credit score. Beyond simple reminders, many apps offer customizable alert settings, allowing users to set thresholds for spending, track progress towards savings goals, and receive notifications about unusual account activity. This proactive approach to financial management can significantly improve financial stability and reduce stress related to money management.

How important are bank integration, data security, and user interface?

Personal finance apps are distinguished by their seamless bank integration, robust security measures, and intuitive design, all of which are critically important for effective financial management.

High-level data protection, including encryption and multi-factor authentication, ensures that users’ private information stays safe, giving them peace of mind while managing their money.

Built-in banking tools make it easy to view account balances instantly, deposit checks remotely, and transfer funds between accounts, adding both convenience and flexibility to everyday financial tasks.

The user-friendly interface simplifies complex financial concepts, making it easier for individuals to understand their spending habits, track their progress toward financial goals, and make informed decisions about their money.

How do personal finance apps assist with debt management?

Personal finance apps significantly aid debt management by offering clear strategies for efficient debt reduction. Many apps provide projected timelines, illustrating the path to becoming debt-free based on current payment progress. Some apps also offer features like debt snowball or debt avalanche calculators to optimize repayment strategies.

Online bill management is streamlined through these apps, eliminating paper statements and manual check writing. Users can automate monthly payments after initial setup, promoting organization and preventing missed due dates. Many apps also send reminders before due dates, offering an additional layer of security against late fees and potential credit score impacts.

What are the potential risks of using personal finance apps for budgeting?

While personal finance apps offer numerous benefits, it’s important to acknowledge potential downsides. These include risks such as data breaches, privacy concerns, and over-dependence on technology.

Weak security measures can expose sensitive financial information, making users vulnerable to identity theft and fraud. To mitigate these risks, prioritize apps that offer robust encryption and multi-factor authentication.

Over-reliance on digital tools without a solid understanding of fundamental financial principles can also lead to poor financial decisions. It’s crucial to strike a balance between using personal finance apps and developing a strong foundation in personal finance management.