Travel rewards credit cards are a must-have for budget-conscious travelers looking to maximize their trips without overspending. These cards allow you to earn points or miles on everyday purchases, which can be redeemed for flights, hotel stays, and other travel expenses. For those who prioritize affordability, no-annual-fee travel credit cards are the perfect solution.

With no annual fees, these cards provide a cost-effective way to enjoy travel perks without worrying about recurring charges. They often include valuable benefits such as rewards on spending, flexible redemption options, and even travel protections, making them an excellent choice for frequent and occasional travelers alike.

In this article, we’ve compiled a list of The Best No-Annual-Fee Travel Credit Cards for 2024, focusing on options that deliver maximum value without added costs. Whether you’re planning your next big adventure or just starting to explore travel rewards, these cards offer the perfect balance of savings and perks. Let’s dive in!

What Makes a No-Annual-Fee Travel Credit Card Worth It?

No-annual-fee travel credit cards are a game-changer for travelers who want to enjoy the benefits of rewards without the added expense of yearly fees. Here’s why they stand out as a valuable choice:

1. Low Cost, High Value

Avoiding annual fees means you can focus on earning rewards without worrying about offsetting the cost of maintaining the card. Every point or mile you earn goes directly toward your travel goals, making these cards a cost-effective option for both frequent and occasional travelers.

2. Rewards on Everyday Spending

No-annual-fee cards often offer generous rewards rates on common spending categories such as dining, groceries, and gas. This allows you to accumulate points or miles through routine purchases, maximizing your rewards potential without changing your spending habits.

3. Flexibility in Rewards and Redemption

The best no-annual-fee travel cards provide versatile redemption options, allowing you to use points or miles for flights, hotels, car rentals, or even statement credits. This flexibility ensures you can adapt your rewards to suit your travel plans, giving you more control over how and when you use them.

4. Added Perks Without Fees

Despite their no-annual-fee structure, these cards often come with valuable extras, such as:

- Travel Protections: Coverage for trip delays, lost luggage, or rental cars.

- No Foreign Transaction Fees: Save money when spending abroad.

- Special Discounts and Offers: Access to exclusive travel deals and partner promotions.

These benefits enhance your travel experience without adding to your costs, making these cards a smart choice for budget-savvy travelers.

By combining affordability, rewards, flexibility, and perks, no-annual-fee travel credit cards offer exceptional value. Whether you’re a seasoned traveler or just starting out, these cards provide a practical way to earn and redeem rewards while keeping costs in check.

Top No-Annual-Fee Travel Credit Cards for 2024

Card 1: Chase Freedom Unlimited®

- Key Features:

- Rewards Rate: Unlimited 1.5% cashback on all purchases, convertible to travel rewards via Chase Ultimate Rewards.

- Sign-Up Bonus: $200 after spending $500 in the first 3 months.

- Unique Perks: 5% cashback on travel purchased through Chase Ultimate Rewards, no foreign transaction fees.

- Why It’s Great: With its high earning potential and no annual fee, this card offers exceptional value for budget travelers who want flexibility in how they use their rewards.

Card 2: Capital One VentureOne Rewards Credit Card

- Key Features:

- Rewards Rate: 1.25 miles per dollar on all purchases.

- Sign-Up Bonus: 20,000 miles after spending $500 in the first 3 months.

- Unique Perks: No foreign transaction fees, miles can be redeemed for travel expenses or transferred to travel partners.

- Why It’s Great: Affordable and easy to use, this card is perfect for frequent travelers looking to save on international trips while earning versatile rewards.

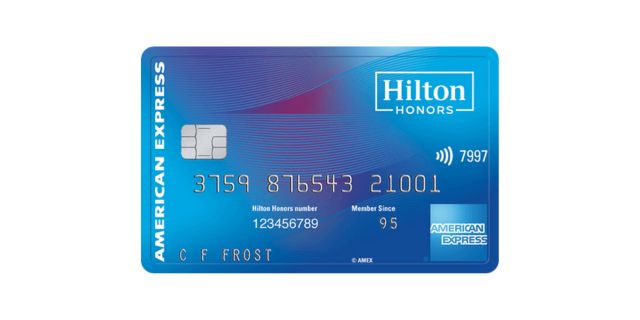

Card 3: Hilton Honors American Express Card

- Key Features:

- Rewards Rate: 7x points on Hilton purchases, 5x points at restaurants, supermarkets, and gas stations, 3x points on all other purchases.

- Sign-Up Bonus: 70,000 Hilton Honors points after spending $1,000 in the first 3 months.

- Unique Perks: Complimentary Hilton Silver status, with perks like late check-out and free breakfast at select properties.

- Why It’s Great: Best suited for travelers who frequently stay at Hilton hotels, this card offers a niche rewards structure with significant value for hotel stays.

Card 4: Discover it® Miles

- Key Features:

- Rewards Rate: Unlimited 1.5 miles per dollar on all purchases.

- Sign-Up Bonus: Matches all miles earned in the first year.

- Unique Perks: Flexible redemption for travel purchases or cashback, no foreign transaction fees.

- Why It’s Great: The first-year bonus match makes this card a standout for new users, effectively doubling the rewards earned during the first year of use.

Card 5: Bank of America® Travel Rewards Credit Card

- Key Features:

- Rewards Rate: 1.5 points per dollar on all purchases.

- Sign-Up Bonus: 25,000 points after spending $1,000 in the first 90 days.

- Unique Perks: Points can be redeemed for a variety of travel expenses with no blackout dates.

- Why It’s Great: With its straightforward rewards system and lack of foreign transaction fees, this card is ideal for both domestic and international travel.

Each of these cards offers a unique set of benefits, allowing budget-conscious travelers to earn and enjoy travel rewards without worrying about annual fees. Choose the card that aligns with your spending habits and travel goals for the best results!

How to Maximize Travel Rewards with No-Annual-Fee Cards

No-annual-fee travel credit cards offer incredible value, but to fully unlock their potential, you’ll need a smart strategy. Here are some tips to help you earn more rewards and get the most from your points or miles:

1. Use Strategic Spending to Earn More Rewards

- Focus on Bonus Categories: Many no-annual-fee cards offer higher rewards rates on specific categories like travel, dining, or groceries. Prioritize spending in these areas to earn points faster.

- Pay for Everyday Purchases: Use your card for routine expenses like utilities, subscriptions, and shopping to rack up rewards effortlessly.

- Time Large Purchases: Plan bigger expenses, such as travel bookings or appliances, to hit spending requirements for sign-up bonuses or seasonal promotions.

2. Combine Cards with Travel Loyalty Programs

- Transfer Rewards to Partners: If your card allows transferring points to airline or hotel loyalty programs, use this feature to unlock higher redemption value.

- Stack Perks: Pair your card’s rewards with loyalty memberships to earn points or miles from both sources simultaneously. For example, use a rewards card to pay for a stay at a hotel chain where you’re already a loyalty member.

- Leverage Status Benefits: Some cards offer complimentary loyalty program status, giving you additional perks like upgrades or free amenities.

3. Follow Best Practices for Redeeming Rewards

- Redeem for Travel: Points and miles often deliver the best value when used for travel-related expenses rather than cashback or gift cards.

- Plan Ahead: Booking flights or accommodations in advance can help you secure lower redemption rates and avoid peak pricing.

- Watch for Promotions: Keep an eye on limited-time offers or transfer bonuses to maximize the value of your points when redeeming them.

By applying these strategies, you can make the most of your no-annual-fee travel credit cards, earning rewards efficiently and stretching their value to cover more of your travel expenses. With careful planning, these cards can help you travel further while keeping costs under control.

Frequently Asked Questions (FAQ)

1. Are no-annual-fee travel cards as good as premium travel cards?

No-annual-fee travel cards are an excellent option for budget-conscious travelers but may lack some of the high-end perks offered by premium cards, such as airport lounge access or comprehensive travel insurance. However, they still provide valuable rewards on everyday spending and can be a better fit if you’re looking to avoid the cost of annual fees. For many travelers, the simplicity and affordability of no-annual-fee cards make them a great alternative.

2. Can I use no-annual-fee travel cards internationally?

Yes, many no-annual-fee travel cards work internationally and even waive foreign transaction fees, saving you money while earning rewards on purchases abroad. Cards like the Capital One VentureOne Rewards Credit Card and Discover it® Miles are particularly traveler-friendly, offering robust benefits for international use. Always confirm your card’s terms to ensure you’re not incurring extra charges.

3. What’s the catch with no-annual-fee travel credit cards?

The primary limitation of no-annual-fee cards is that they often have fewer perks or lower rewards rates compared to premium travel cards. For example, you may not receive benefits like trip cancellation insurance or statement credits for travel expenses. However, these cards are still a great choice for travelers who value affordability and straightforward rewards.

4. How do these cards compare to cashback cards?

No-annual-fee travel cards and cashback cards cater to different needs:

- Travel Cards: Offer points or miles that can be redeemed for travel expenses, often with higher value for flights, hotels, or car rentals.

- Cashback Cards: Provide straightforward cash rewards, which can be used for any expense.

If you travel frequently, a no-annual-fee travel card is likely more beneficial due to its travel-specific perks. If you prefer flexibility without focusing on travel, a cashback card might be the better option.

Conclusion

No-annual-fee travel credit cards are a fantastic choice for travelers who want to earn rewards without the added expense of yearly fees. These cards provide a cost-effective way to accumulate points or miles through everyday spending, offering valuable perks such as flexible redemptions, travel protections, and no foreign transaction fees.

Whether you’re a frequent flyer or a casual traveler, there’s a no-annual-fee card that can help you reach your travel goals. By choosing a card that aligns with your spending habits and travel preferences, you can unlock a world of rewards and enjoy your journeys without breaking the bank.

Have you found your perfect no-annual-fee travel credit card? Share your experiences or ask questions in the comments below — we’d love to hear from you!