Traveling as a student is often a dream come true. Whether it’s exploring a new city during a semester break, studying abroad, or simply visiting family, the opportunity to see the world is invaluable. But let’s face it—traveling on a student budget isn’t always easy. That’s where the right travel rewards card can make a world of difference.

By choosing a card that aligns with your lifestyle, you can earn points, miles, and cashback to offset travel expenses and make those trips more affordable. From earning rewards on everyday purchases to unlocking exclusive travel perks, having the right card in your wallet is like having a travel companion that pays you back.

So, which travel rewards card is best for students? In this guide, we’ll help you navigate the options, break down the benefits, and find the perfect card to turn your travel dreams into reality.

Why Should Students Consider Travel Rewards Cards?

Travel rewards cards aren’t just for seasoned travelers—they’re a fantastic tool for students who want to explore the world without breaking the bank. Here’s why these cards are worth considering:

1. Benefits for Budget-Friendly Travel

Travel rewards cards make it easier to travel on a student budget by offering perks like miles, points, or cashback. Every purchase you make, from textbooks to coffee, could contribute to your next trip. These rewards can be redeemed for flights, hotel stays, or other travel expenses, saving you money on your adventures. Some cards even offer sign-up bonuses that can significantly boost your rewards balance right from the start.

2. Opportunity to Build Credit History

Using a travel rewards card responsibly is also a smart way to build your credit history. A strong credit score is essential for future financial milestones, like renting an apartment or buying a car. By paying your balance on time and managing your spending, you not only earn rewards but also establish a solid credit foundation for the future.

3. Reward Programs Tailored to Student Lifestyles

Many travel rewards cards are designed with students in mind. They come with no annual fees, lower credit requirements, and rewards that match everyday spending habits, such as dining out or commuting. Some cards even include travel protections, like trip cancellation insurance or discounts with travel partners, making them perfect for students planning trips locally or abroad.

By choosing the right travel rewards card, students can enjoy the best of both worlds—smart financial habits and the freedom to travel more. It’s a win-win for any young explorer.

Key Factors to Consider When Choosing the Best Travel Rewards Card for Students

Selecting the right travel rewards card can feel overwhelming, but focusing on the key factors that matter most to students can make the decision easier. Here are the main points to consider:

1. Annual Fees

As a student, every dollar counts, and paying a high annual fee may not be feasible. Fortunately, many travel rewards cards for students offer no-annual-fee options, allowing you to enjoy rewards and benefits without an added financial burden. Be sure to weigh the value of any fees against the perks offered to determine if they’re worth it.

2. Relevant Rewards

Not all rewards programs are created equal, so it’s essential to choose a card that aligns with your spending habits and travel goals. Look for cards that offer:

- Points for miles: Perfect for flights to study abroad or vacations.

- Discounts on accommodation: Ideal for budget-friendly stays during trips.

- Cashback for transportation: Great for everyday expenses like rideshares or public transit.

The more relevant the rewards, the more value you’ll get from your card.

3. Ease of Approval

Many students don’t have an extensive credit history, which can make it challenging to get approved for traditional travel cards. Luckily, some cards are specifically designed for students, offering easier approval processes and lower credit score requirements. These options help students get started on their financial journey while earning valuable travel perks.

4. Extra Perks

Beyond rewards, some travel cards include extra benefits that can enhance your travel experience, such as:

- Travel protections: Trip cancellation insurance, lost luggage reimbursement, or travel delay coverage.

- Discounts with specific partners: Savings on flights, hotels, or experiences with partnered brands.

These perks can add significant value, especially for frequent travelers or those planning extended trips abroad.

By focusing on these factors, students can find a travel rewards card that not only fits their budget and lifestyle but also helps them make the most of every adventure.

Comparison of the Best Travel Rewards Cards for Students

Selecting the right travel rewards credit card can significantly enhance your travel experiences while helping you build credit. Here are three top options for students in the United States, each offering unique benefits:

1. Bank of America® Travel Rewards Credit Card for Students

This card is ideal for students seeking straightforward travel rewards without the burden of annual fees. It offers unlimited 1.5 points per dollar spent on all purchases, with no expiration on points. New cardholders can earn 25,000 online bonus points after making at least $1,000 in purchases within the first 90 days, redeemable as a $250 statement credit toward travel purchases. Additionally, there are no foreign transaction fees, making it a great choice for students planning to study abroad or travel internationally.

2. Discover it® Student Chrome

Designed with students in mind, this card offers 2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter, and unlimited 1% cash back on all other purchases. A standout feature is Discover’s Cashback Match™, which matches all the cash back you’ve earned at the end of your first year, automatically. With no annual fee and access to your FICO® Credit Score for free, it’s a solid option for students looking to build credit while earning rewards.

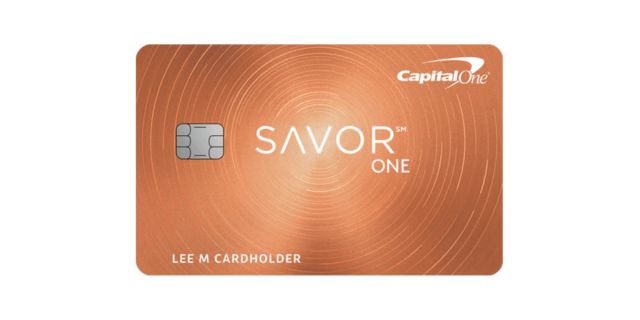

3. Capital One SavorOne Student Cash Rewards Credit Card

This card is tailored for students who enjoy dining and entertainment. It offers unlimited 3% cash back on dining, entertainment, popular streaming services, and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases. There’s no annual fee, and cardholders can earn a $50 cash bonus after spending $100 in the first three months. The card also comes with no foreign transaction fees, making it suitable for international travel.

Which Card Should You Choose?

- If you’re looking for flexible travel rewards with no annual fee, the Bank of America® Travel Rewards Credit Card for Students is a strong contender.

- For cash back on gas and dining, the Discover it® Student Chrome offers valuable rewards and a first-year cash back match.

- If your spending focuses on dining and entertainment, the Capital One SavorOne Student Cash Rewards Credit Card provides higher cash back in those categories.

Assess your spending habits and travel plans to select the card that aligns best with your lifestyle and financial goals.

Tips for Maximizing Rewards Benefits

Once you’ve chosen the perfect travel rewards card, the next step is making the most of its benefits. With smart usage, you can quickly rack up rewards and enjoy valuable perks. Here are some practical tips to maximize your rewards:

1. Use Your Card for Essential Expenses

To build rewards quickly, use your travel rewards card for everyday purchases like groceries, transportation, dining, and online subscriptions. These are expenses you’re already making, so by shifting them to your card, you’ll accumulate points, miles, or cashback without changing your budget.

2. Pay Your Balance in Full Every Month

Carrying a balance on your card can lead to interest charges, which can quickly offset the rewards you earn. To avoid this, always pay your statement balance in full by the due date. This practice not only helps you avoid debt but also builds a strong credit history—an added benefit for students starting their financial journey.

3. Take Advantage of Exclusive Promotions

Many travel rewards cards offer bonus rewards or special promotions, such as extra points for spending in specific categories or during certain times of the year. Keep an eye out for these opportunities and adjust your spending when possible to multiply your rewards. For example, if your card offers double miles on dining for a limited time, plan a few meals out with friends to take advantage of the bonus.

By following these tips, you’ll maximize the value of your travel rewards card, helping you save more on trips and enjoy a range of exclusive benefits. Every purchase can bring you one step closer to your next adventure!

FAQ

1. What’s the main advantage of a travel rewards card for students?

The main advantage of a travel rewards card for students is that it helps turn everyday spending into travel benefits. From earning miles and cashback to unlocking discounts on flights and hotels, these cards make traveling more affordable. Additionally, they often include perks like travel protections, which can provide peace of mind during trips. Plus, they’re a great way to start building credit while enjoying rewards.

2. Can students with no credit history get approved?

Yes, many travel rewards cards are specifically designed for students with little to no credit history. These cards typically have lower approval requirements and may even offer tools to help students build their credit, such as free credit score tracking. If you’re new to credit, start with a student-friendly card and use it responsibly to establish a strong financial foundation.

3. Is it worth paying an annual fee for better benefits?

It depends on your spending habits and travel goals. If the card’s rewards and perks (such as higher point earning rates, travel insurance, or exclusive discounts) outweigh the annual fee, then it could be worth it. For example, frequent travelers might find a card with a $25 annual fee and robust travel benefits more valuable than a no-annual-fee card with limited perks. However, if you’re a casual traveler or prefer to avoid fees altogether, a no-annual-fee option might be a better fit. Always evaluate whether the benefits align with your needs.

Conclusion

Travel rewards cards offer students a unique opportunity to turn everyday spending into exciting travel experiences. By choosing the right card, you can enjoy benefits like earning miles, cashback, or discounts on flights and hotels—all while building your credit history. Whether you’re looking for no-annual-fee options, tailored rewards for your lifestyle, or added travel protections, there’s a card out there that fits your needs.

As a student, it’s essential to evaluate your spending habits and travel goals to select a card that maximizes your benefits. Take the time to research and compare options to ensure you’re making the best choice for your situation.

The right travel rewards card can help make your travel dreams more affordable and accessible. Start exploring your options today, and take the first step toward your next adventure!